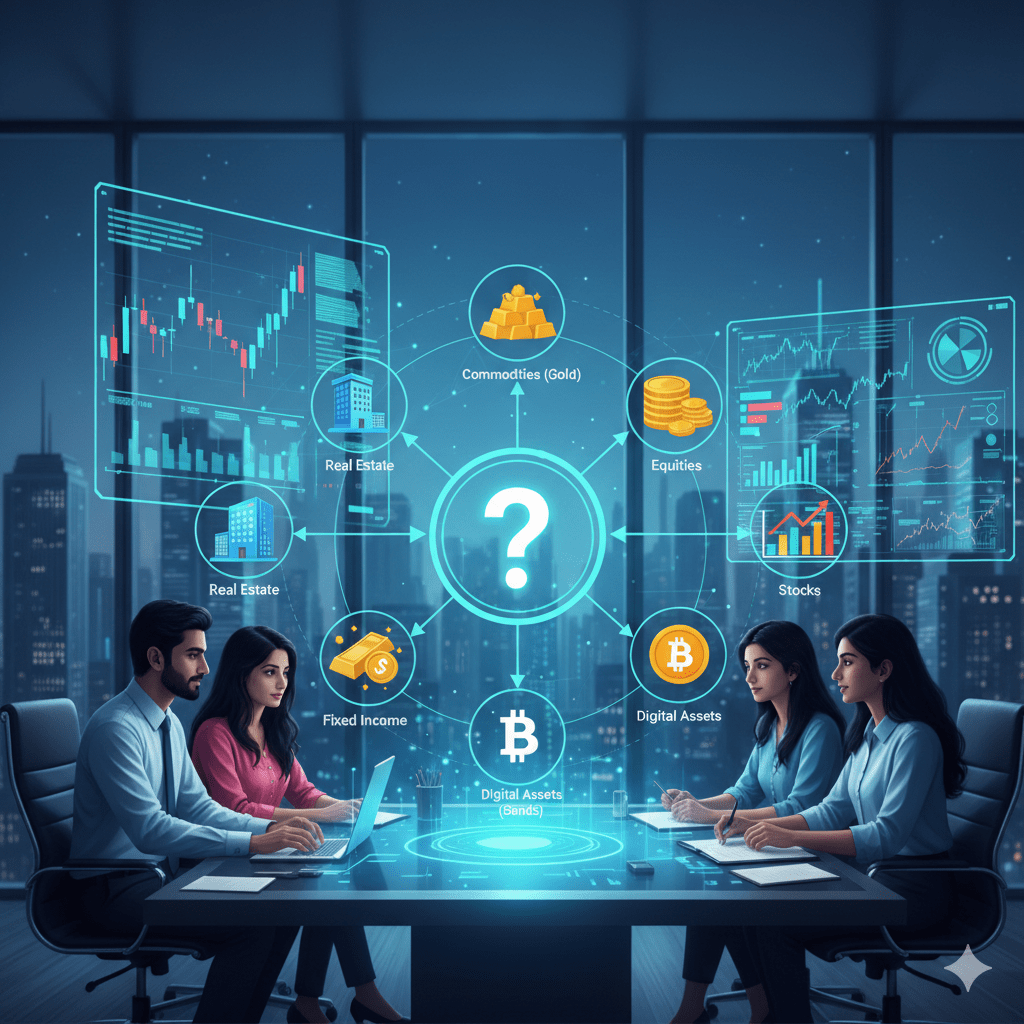

Ultimate Beginner Investing Guide: Which Asset Classes Should Beginners Choose in 2026?

Summary: Discover the essential asset classes every beginner investor needs to understand in 2026. Moreover, this comprehensive guide reveals proven investment strategies. Furthermore, you’ll learn how to build wealth systematically.

Most new investors feel completely overwhelmed by investment choices. However, understanding basic asset classes transforms your financial future. Therefore, this beginner investing guide 2026 asset classes breakdown simplifies everything.

Cash: Your Essential Financial Foundation

Cash provides ultimate security for short-term goals. Additionally, it offers instant liquidity when emergencies arise. Nevertheless, inflation slowly erodes cash value over time.

Key benefits include:

- Immediate access to funds

- Zero investment risk

- Perfect for emergency funds

- Ideal for 3-6 months expenses

Stocks: Powerful Wealth Building Engines

Individual stocks offer explosive growth potential for patient investors. However, they require careful research and risk management. Furthermore, diversification becomes absolutely crucial for success.

According to recent data, the S&P 500 delivered 10.5% average returns over decades. Moreover, successful stock picking demands extensive market knowledge.

Index Funds: Smart Diversification Strategy

Index funds provide instant diversification across hundreds of companies. Additionally, they offer lower fees than actively managed funds. Therefore, beginners often choose index funds first.

Benefits include:

- Automatic diversification

- Low management fees

- Consistent market returns

- Perfect for beginners

REITs: Real Estate Without Hassles

Real Estate Investment Trusts offer property exposure without landlord responsibilities. Furthermore, they provide steady dividend income streams. However, interest rate changes affect REIT performance significantly.

Recent market data shows REITs generated 8-12% annual returns historically. Moreover, they complement traditional stock portfolios effectively.

Gold: Time-Tested Wealth Protector

Gold serves as a reliable hedge against market volatility. Additionally, it preserves purchasing power during inflation periods. Nevertheless, gold doesn’t generate income like dividend stocks.

Current gold prices reached record highs in December 2025. Furthermore, experts recommend 5-10% portfolio allocation to precious metals.

Cryptocurrency: High-Risk Digital Assets

Crypto offers massive growth potential but extreme volatility risks. However, blockchain technology continues revolutionizing financial systems. Therefore, only invest money you can afford losing.

Bitcoin and Ethereum remain the most established cryptocurrencies. Moreover, regulatory clarity improves crypto investment safety gradually.

FAQ Section

Which Asset Classes Work Best for Beginners?

Index funds provide excellent starting points for new investors. Additionally, they offer broad market exposure with minimal risk. Furthermore, emergency cash funds remain absolutely essential always.

How Much Should Beginners Invest Monthly?

Start with any amount you can afford consistently. Moreover, even £20-50 monthly builds wealth over time. Therefore, consistency matters more than initial investment size.

What Percentage Should Go Into Each Asset?

Young investors typically allocate 80% stocks, 20% bonds. However, risk tolerance determines optimal asset allocation strategies. Furthermore, professional guidance helps optimize portfolio balance.

References

- YouTube: Nischa – The Only Investing Video You’ll Ever Need in 2026

- S&P 500 Historical Returns – Yahoo Finance

- Gold Price Data – London Bullion Market Association

- REIT Performance Statistics – NAREIT