India’s journey towards a digital economy has hit a new milestone. The Reserve Bank of India (RBI) has initiated Phase 2 of its Central Bank Digital Currency (CBDC), the Digital Rupee (e₹). Building on the learnings from the initial pilot, this new phase expands the scope and introduces features that could redefine digital transactions for millions. Get the full analysis at INDwallet.com.

Table of Contents

- What’s New in Digital Rupee Phase 2?

- What Do Financial Leaders Say?

- Is Digital Rupee a UPI Killer?

- What This Means For You

- Frequently Asked Questions

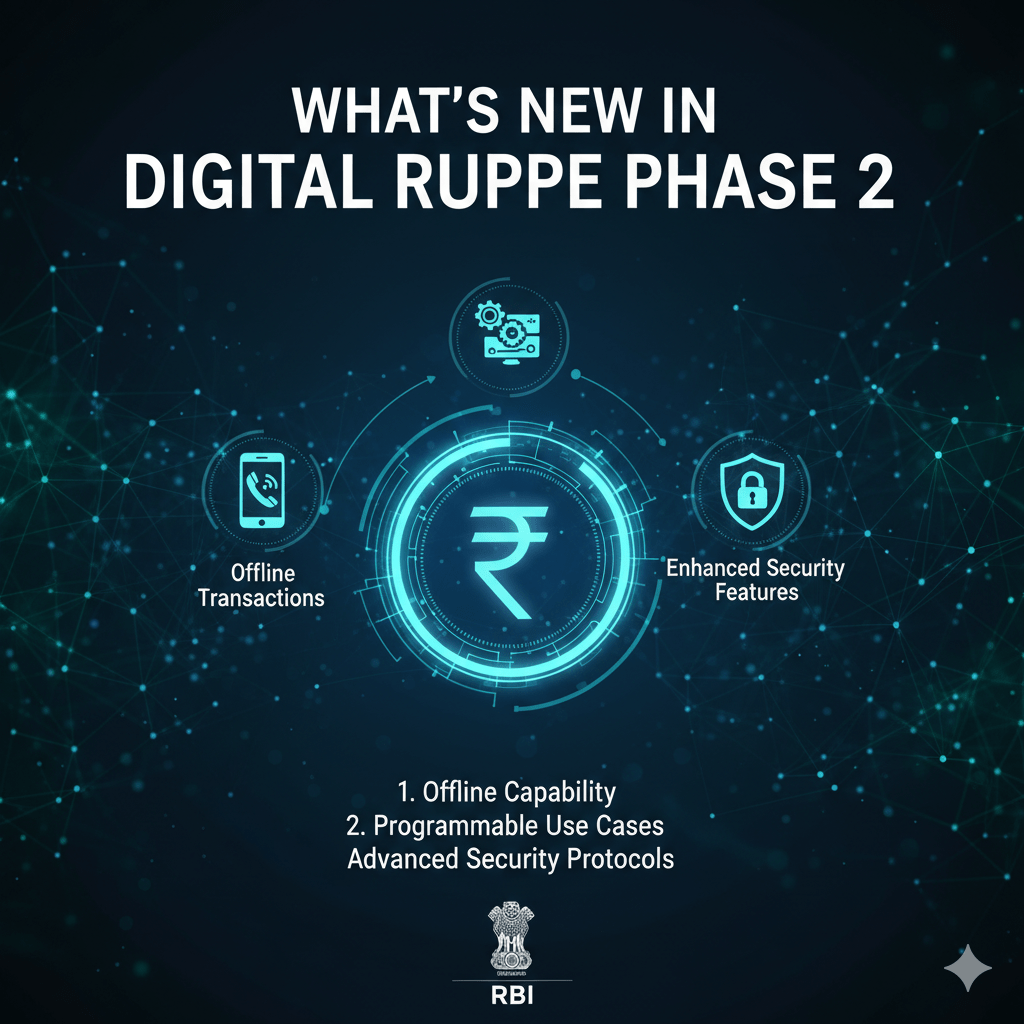

What’s New in Digital Rupee Phase 2?

Phase 2 is not just about adding more users and cities. It’s a strategic expansion focused on testing two groundbreaking features: offline functionality and programmability. The ability to transact without a live internet connection is a potential game-changer for financial inclusion in areas with patchy connectivity. Furthermore, programmability could enable targeted payments, ensuring government subsidies or corporate benefits are used for their intended purpose.

What Do Financial Leaders Say?

Top officials have consistently emphasized that the Digital Rupee is an evolution, not a disruption. The goal is to offer a digital alternative that carries the same trust and finality as physical cash.

Like physical currency, [CBDC] will not earn any interest. It can be exchanged for any other form of money. The development of CBDC could provide the public with a risk-free virtual currency that will give them a legitimate alternative to private virtual currencies.

Is Digital Rupee a UPI Killer?

This is the most common question, and the answer is a definitive no. UPI is a payments platform that facilitates bank-to-bank transfers. The Digital Rupee is the currency itself—a direct liability of the RBI. They serve different purposes and are designed to coexist and even integrate.

UPI is a payment system, whereas the CBDC is money itself. In UPI, the transaction is of commercial bank money… CBDC is central bank money. When you use a CBDC, you are using your money which is a liability of the central bank. So the degree of finality is much higher.

Think of it this way: UPI is the highway, and the money in your bank account is the car. The Digital Rupee is a new type of car—an electric vehicle, perhaps—that can also run on the same highway. It offers unique features but doesn’t aim to replace all other cars.

What This Means For You

- Enhanced Safety: The e₹ is the safest form of digital money, backed directly by the RBI.

- Financial Inclusion: Offline features will bring digital payments to areas where the internet is unreliable.

- Potential for Innovation: Programmable money could lead to new financial products and services.

The rollout of Phase 2 is a carefully calibrated step. While mass adoption is still some time away, it signals a clear direction for the future of money in India. The focus remains on a seamless, secure, and inclusive digital payment experience for all citizens.

Conclusion

The Digital Rupee Phase 2 represents a significant milestone in India’s digital transformation journey. With features like offline functionality and programmability, it promises to enhance financial inclusion while maintaining the trust and security of traditional currency. As this technology evolves, it will be crucial to monitor its adoption and impact on the broader financial ecosystem.

Frequently Asked Questions

• What makes Digital Rupee different from UPI?

UPI is a payment system that transfers bank money, while Digital Rupee is actual central bank money. The e₹ offers higher finality and is a direct liability of the RBI.

• Can I use Digital Rupee without internet?

Yes, Phase 2 introduces offline functionality, allowing transactions even without internet connectivity, which is particularly beneficial for rural areas.

• Will Digital Rupee earn interest?

No, like physical currency, the Digital Rupee will not earn any interest. It’s designed to function as digital cash.

• How secure is the Digital Rupee?

It’s the safest form of digital money as it’s a direct liability of the RBI, carrying no credit or liquidity risk unlike commercial bank deposits.

• When will Digital Rupee be available nationwide?

The RBI is taking a phased approach. Phase 2 is currently expanding to more cities and banks. Full nationwide rollout timeline depends on pilot success and regulatory approvals.

Additional Resources

For more insights on India’s evolving financial landscape, visit INDwallet.com

Disclaimer: This article is for informational purposes only and should not be considered as financial advice. Please consult with a qualified financial advisor before making any investment decisions. INDwallet.com does not guarantee the accuracy of the information provided and is not liable for any financial losses.