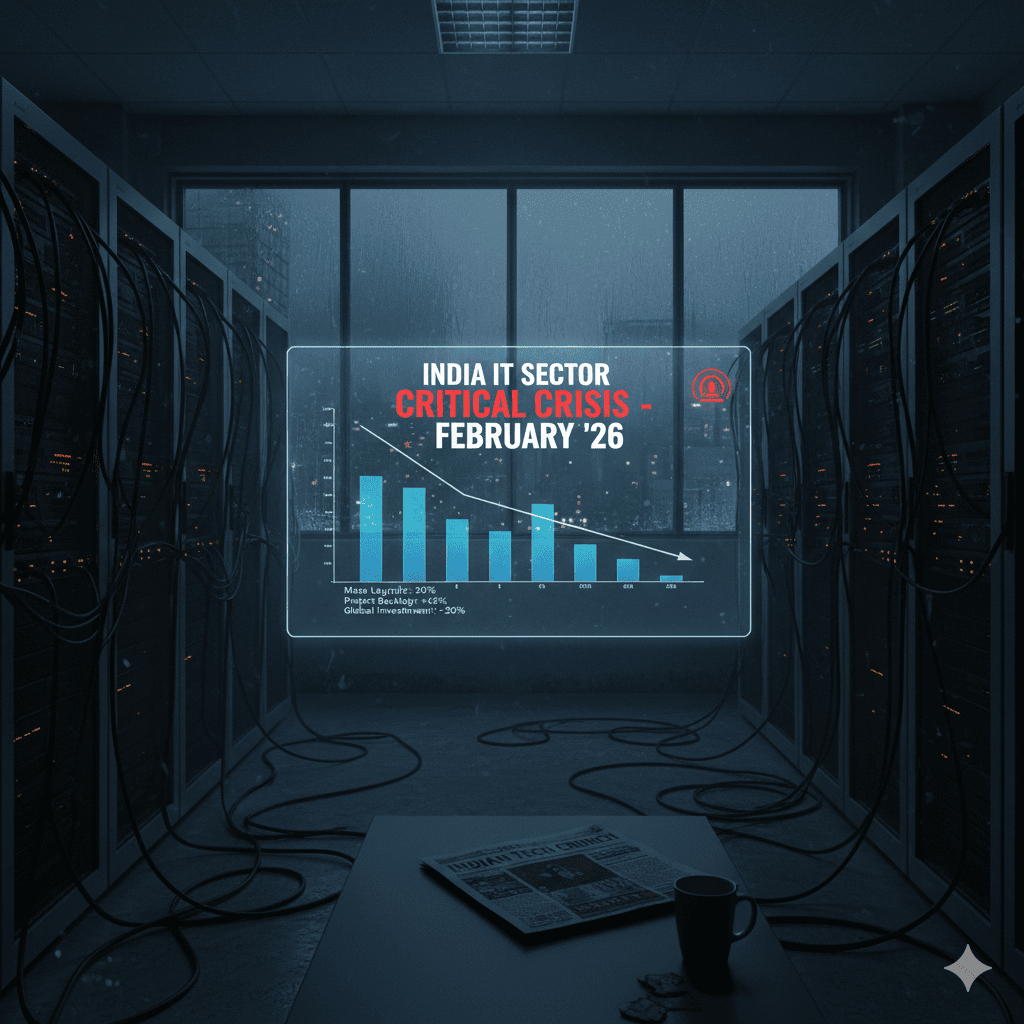

India’s robust IT sector faces significant new challenges. Moreover, AI disruption and global economic shifts create fresh risks. Therefore, investors must thoroughly understand these concerns for informed decisions.

Key Challenges Facing India IT

Firstly, global economic slowdowns impact demand. Clients reduce spending on IT services. Consequently, revenue growth slows for many firms. indwallet.com

Additionally, rising operational costs present difficulties. Wage inflation in India affects profit margins. Thus, companies face pressure from both ends.

AI Disruption: A Game Changer

Artificial intelligence is rapidly advancing. Moreover, generative AI tools automate many tasks. Therefore, traditional India IT services face profound shifts.

For instance, coding and testing can be AI-assisted. This reduces the need for human labor. Consequently, job growth might slow down.

Market Outlook and Investment Risks

The market outlook appears complex. Some analysts predict slower growth. However, others see opportunities in niche AI services.

Investors face increased risks. Valuation multiples might contract. Therefore, careful stock selection becomes vital.

Essential Investor Guidance

Firstly, diversify your portfolio. Do not over-allocate to one sector. This strategy reduces overall risk.

Moreover, research companies deeply. Look for firms innovating with AI. Strong balance sheets are also crucial.

In conclusion, India’s IT sector faces real challenges. However, informed investors can navigate these waters. Prudent decisions are paramount.

FAQs on India IT Investments

Q: What is “India IT Doom”?

A: “India IT Doom” refers to significant challenges. These include global slowdowns and AI disruption. They pose risks to the sector.

Q: How does AI affect India’s IT sector?

A: AI automates many traditional IT tasks. This reduces demand for human services. Moreover, it forces companies to innovate.

Q: Should I sell all my India IT stocks?

A: Not necessarily. Instead, assess individual companies. Focus on those adapting to new technologies. Diversification is key.

Q: What are key risks for investors?

A: Risks include slower growth and margin pressure. Additionally, AI investment costs are high. Valuations might also decrease.