Building a robust emergency fund is essential for financial security in India’s dynamic economy. This comprehensive guide covers everything you need to know about creating and maintaining an emergency fund in 2025. IndWallet.com

Table of Contents

- Why Emergency Fund Matters in 2025

- How Much Should You Save

- Best Investment Options

- 7 Proven Building Strategies

- Common Mistakes to Avoid

Why Emergency Fund Matters in 2025

In November 2025, India’s household debt has surged to 43.5% of GDP, making emergency funds more crucial than ever. Financial experts recommend that families should maintain an emergency corpus to handle unexpected expenses without falling into debt traps.

Current Economic Landscape

Recent data shows that household net financial savings have recovered to 7.3% of GDP in H1FY25 from a 47-year low of 5.0% in FY23. However, the rise in non-housing personal loans, which now constitute 32.3% of GDP, highlights the importance of having a financial safety net.

“Financial experts and market veterans recommend that individuals should aim to save between three to six months worth of essential expenses. For example, a family with monthly expenditure of Rs 50,000 should consider setting aside Rs 1.5 lakhs to Rs 3 lakhs as an emergency corpus.” – Mint Financial Analysis

Key Benefits of Emergency Fund

- Financial Security: Protection against job loss or income reduction

- Peace of Mind: Reduced stress during unexpected situations

- Avoid Debt: Prevents reliance on high-interest credit cards

- Medical Emergencies: Coverage for unexpected healthcare costs

How Much Should You Save

The ideal emergency fund size depends on your income stability and family situation. According to recent research, it takes approximately 15 months for an average Indian to build an emergency fund equivalent to three times their monthly income.

Emergency Fund Calculator

Based on Employment Type

- Salaried Employees: 3-6 months of expenses

- Business Owners: 6-9 months of expenses

- Freelancers: 9-12 months of expenses

- Government Employees: 3-4 months of expenses

Sample Emergency Fund Calculation

For a family with monthly expenses of Rs 40,000:

- Minimum Fund: Rs 1.2 lakhs (3 months)

- Recommended Fund: Rs 2.4 lakhs (6 months)

- Conservative Fund: Rs 3.6 lakhs (9 months)

Best Investment Options for Emergency Fund

Traditional savings accounts offer limited returns. Modern India investing strategies focus on liquid instruments that beat inflation while maintaining accessibility.

Top Emergency Fund Investment Options

High-Yield Savings Accounts

Digital banks now offer up to 7-8% interest rates on savings accounts, making them attractive for emergency fund parking with instant liquidity.

Liquid Mutual Funds

Liquid funds provide better returns than savings accounts with T+1 redemption. These funds invest in short-term money market instruments and offer flexibility.

Sweep-in Fixed Deposits

These hybrid instruments automatically transfer excess funds from savings to FD, earning higher interest while maintaining liquidity for emergencies.

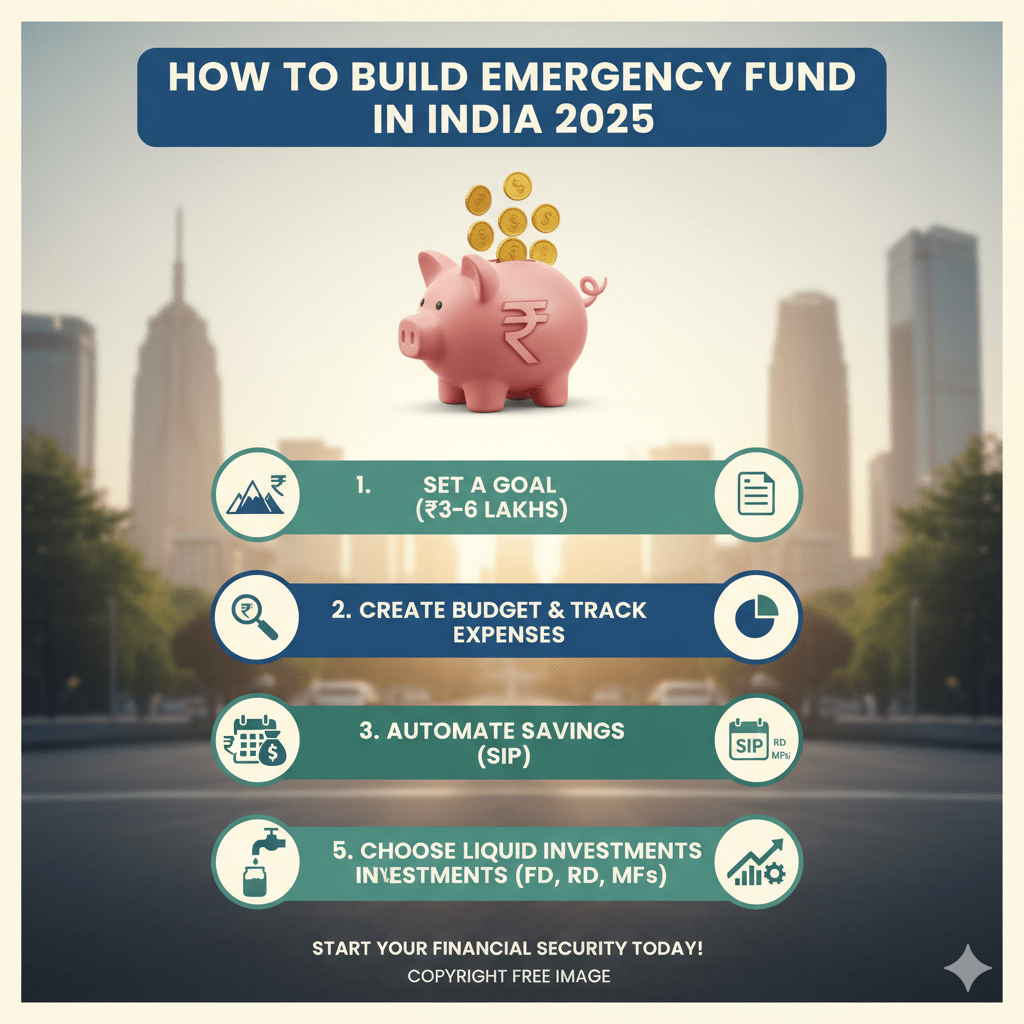

7 Proven Building Strategies

Building an emergency fund requires disciplined approach and smart financial planning. Here are proven strategies recommended by financial experts for 2025.

Strategy 1: Start Small and Be Consistent

Begin with manageable amounts such as Rs 2,000 to Rs 5,000 monthly. Gradually increase contributions over time as your income grows.

Strategy 2: Automate Your Savings

Set up automatic transfers to a dedicated emergency fund account. This ensures regular contributions without manual intervention.

Automation Benefits

- Consistency: Regular contributions without fail

- Discipline: Removes temptation to skip savings

- Growth: Compound effect over time

Strategy 3: Utilize Appropriate Financial Instruments

Park funds in high-interest savings accounts, mutual funds, or sweep-in fixed deposits after consulting with your financial advisor.

Strategy 4: Avoid Risky Investments

Stay away from volatile assets such as penny stocks or volatile equities for your emergency fund. Focus on capital preservation over growth.

Strategy 5: Review and Adjust Periodically

Life circumstances evolve with time. Consistently review your emergency fund to ensure it aligns with current financial needs.

Review Triggers

- Job Changes: Salary increases or decreases

- Family Changes: Marriage, children, dependents

- Medical Needs: Chronic conditions or health issues

- Lifestyle Changes: Moving cities or changing expenses

Strategy 6: Complement with Health Insurance

A reasonable health insurance policy from a reputable company reduces the burden on your emergency fund for medical expenses.

Strategy 7: Consider Economic Indicators

Factor in current economic conditions when building your emergency fund, including inflation rates and job market stability.

Common Mistakes to Avoid

Many Indians make critical errors in wealth planning India strategies. Avoiding these mistakes can significantly improve your emergency fund effectiveness.

Major Emergency Fund Mistakes

- Investing in Volatile Assets: Emergency funds should not be in risky investments

- Insufficient Amount: Underestimating required corpus for your lifestyle

- Poor Liquidity: Choosing instruments with lock-in periods

- No Regular Review: Failing to adjust fund size with life changes

- Using for Non-Emergencies: Dipping into fund for planned expenses

What Constitutes a Real Emergency

- Job Loss: Sudden unemployment or income reduction

- Medical Emergency: Unexpected healthcare expenses

- Home Repairs: Critical maintenance or damage

- Family Emergency: Supporting family members in crisis

Frequently Asked Questions

- How much emergency fund do I need in India? – Typically 3-6 months of monthly expenses depending on job stability and family situation

- Where should I invest my emergency fund? – High-yield savings accounts, liquid mutual funds, or sweep-in fixed deposits for optimal liquidity

- Can I use my emergency fund for planned expenses? – No, emergency funds should only be used for genuine unexpected expenses or financial crises

- How long does it take to build an emergency fund? – On average, 15 months for Indians to build a fund equivalent to 3 times monthly income

- Should I prioritize emergency fund over investments? – Yes, build your emergency fund first before focusing on long-term investments for financial security

Disclaimer: This article is for informational purposes only and should not be considered as financial advice. Please consult with a qualified financial advisor before making any investment decisions. INDwallet.com does not guarantee the accuracy of the information provided and is not liable for any financial losses.