Ultimate Home Loan Eligibility Guide India 2026

Discover essential home loan eligibility criteria India 2026. Moreover, learn about interest rates, documents, and approval tips. Furthermore, get expert guidance for successful applications.

Critical Home Loan Requirements You Must Know

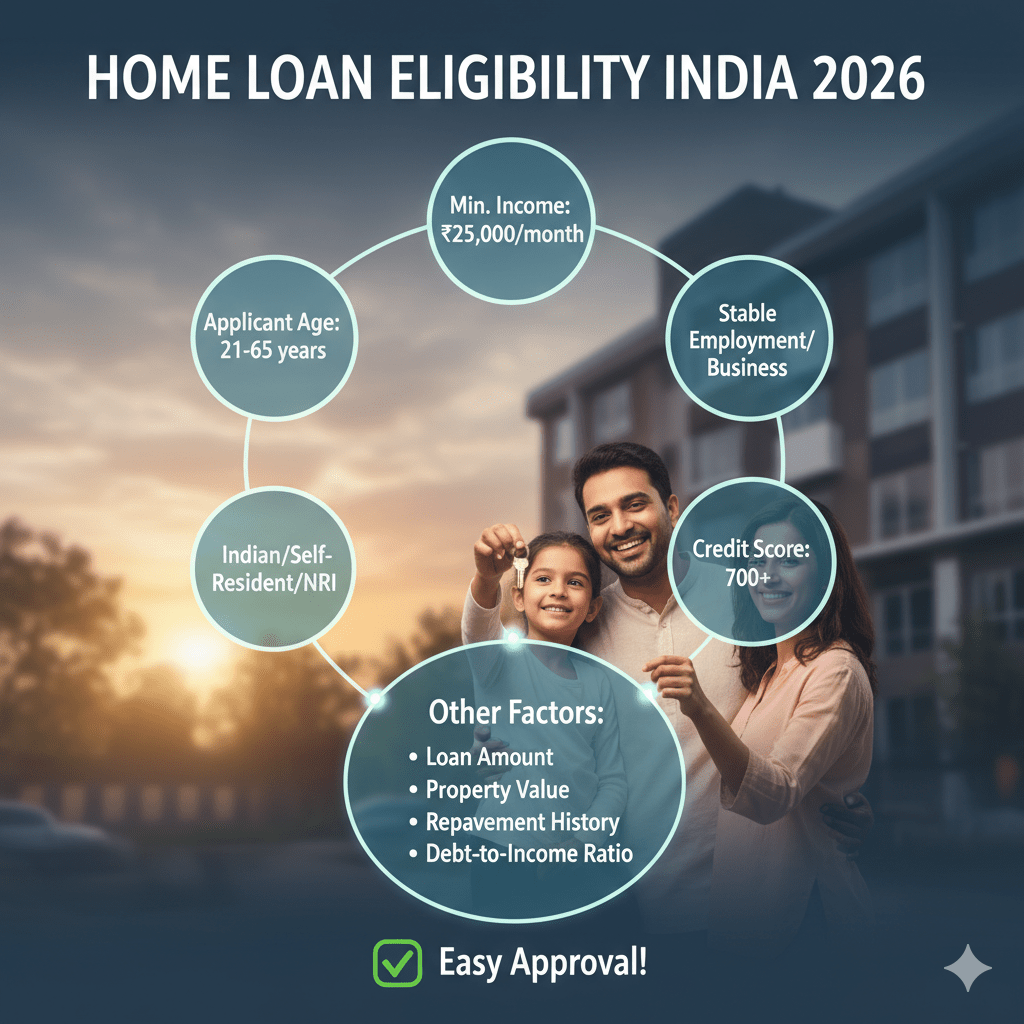

Getting a home loan requires meeting specific eligibility criteria. However, many applicants struggle with complex requirements. Therefore, understanding home loan eligibility criteria India 2026 becomes crucial.

Banks evaluate multiple factors before loan approval. Additionally, they assess your financial stability carefully. Furthermore, documentation plays a vital role in decisions.

Essential Income Requirements for Home Loans

- Minimum monthly income: ₹10,000 for salaried individuals

- Self-employed income: ₹15,000 monthly business income

- Age criteria: 18-65 years for applicants

- Employment stability: 2+ years current job

Moreover, banks prefer stable income sources. Therefore, consistent salary credits improve approval chances. Additionally, multiple income sources strengthen applications.

Powerful Documentation Checklist for Success

Proper documentation ensures faster loan processing. However, incomplete papers cause delays. Therefore, prepare these documents beforehand:

- Identity proof: Aadhaar, PAN, passport

- Income proof: Salary slips, ITR, bank statements

- Address proof: Utility bills, rental agreements

- Property documents: Sale deed, NOC certificates

Furthermore, banks verify all documents thoroughly. Additionally, original documents speed up verification. Moreover, digital copies help initial screening.

Current Home Loan Interest Rates 2026

Interest rates significantly impact loan affordability. However, rates vary across lenders. Therefore, compare options carefully:

- Public sector banks: 7.10% – 7.50% per annum

- Private banks: 7.15% – 8.35% per annum

- Housing finance companies: 7.40% – 9.00% per annum

Moreover, IndWallet helps compare rates effectively. Additionally, credit scores influence interest rates. Furthermore, higher scores secure better rates.

Smart Tips for Loan Approval Success

Improving approval chances requires strategic planning. However, many applicants make common mistakes. Therefore, follow these proven strategies:

- Maintain high credit score: Above 750 preferred

- Reduce existing debts: Lower debt-to-income ratio

- Choose appropriate tenure: Balance EMI and interest

- Provide co-applicant: Increases loan eligibility

Additionally, pre-approved loans offer advantages. Moreover, existing bank relationships help. Furthermore, stable employment history matters significantly.

Frequently Asked Questions

What determines home loan eligibility criteria?

Banks evaluate income, credit score, and employment stability. Moreover, they assess debt-to-income ratios carefully. Additionally, property value influences loan amounts.

How can I improve loan approval chances?

Maintain excellent credit scores above 750. Furthermore, reduce existing debts significantly. Additionally, provide complete documentation promptly.

Which banks offer lowest interest rates?

Public sector banks currently offer competitive rates. However, private banks provide faster processing. Therefore, compare both options thoroughly.