Discover how AI financial planning empowers rural India. Learn about personalized advice, credit access, and future growth.

Summary

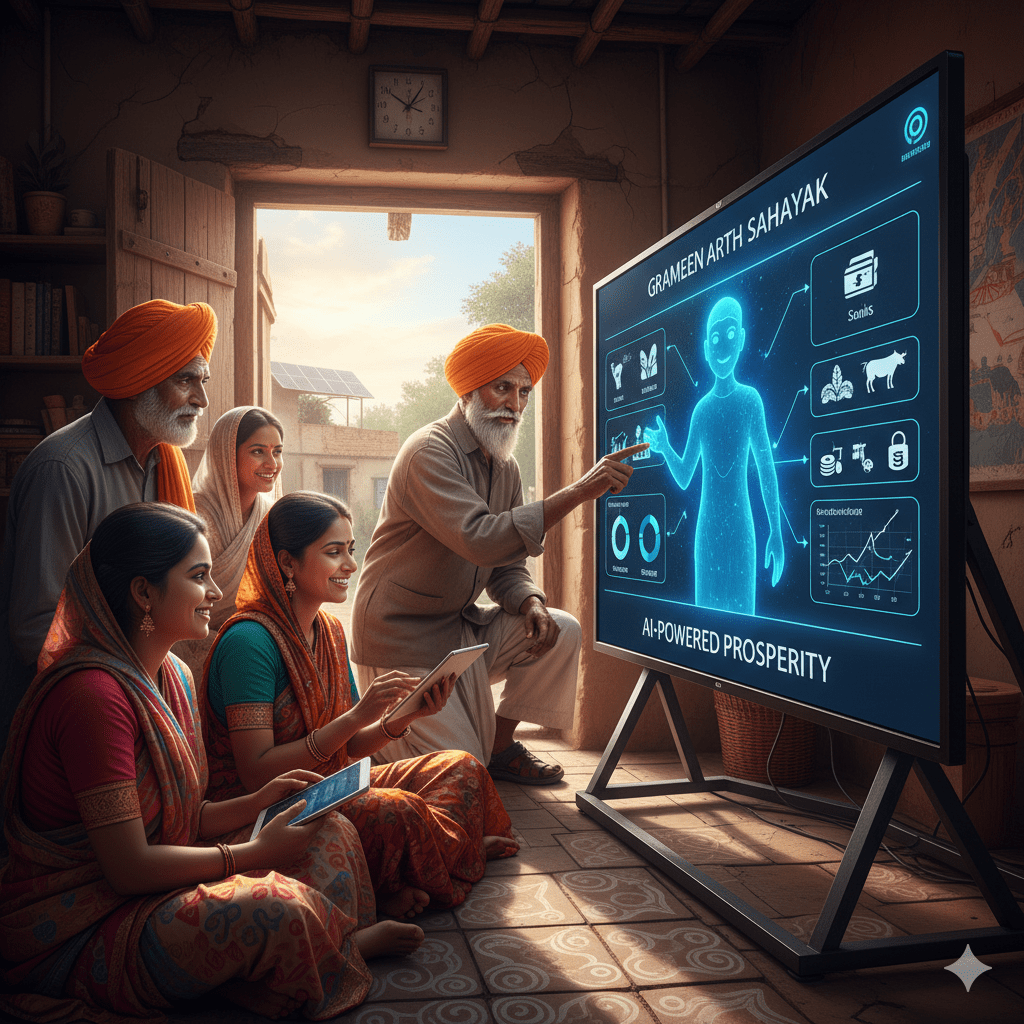

Can artificial intelligence truly transform rural Indian financial lives? Yes, it can. AI financial planning offers innovative solutions. It addresses unique needs in rural areas. This technology promises greater financial inclusion. It helps individuals manage money better. AI provides personalized advice. It opens doors to new credit options. Rural communities can achieve financial stability. This is a significant step forward. Indwallet.com

AI Financial Planning: A Rural Revolution

AI offers powerful financial solutions. It targets rural India’s unique needs. This technology provides personalized advice. It enhances financial decision-making. AI tools analyze complex data. They understand income volatility. Many rural incomes depend on agriculture. AI helps manage these fluctuating funds. It is a game-changer for financial inclusion.

Bridging the Financial Inclusion Gap

Financial inclusion remains a challenge. Many rural Indians lack bank access. AI platforms can reach remote areas. They offer services via mobile phones. This lowers barriers to entry. Therefore, more people get financial help.

Tailored Advice for Farmers

Farmers face specific financial risks. Crop failures or price drops impact income. AI analyzes weather patterns. It predicts market price movements. Thus, it offers proactive financial advice. Farmers can plan for lean periods. They can also secure better loan terms.

Accessing Digital Credit

Traditional credit is often unavailable. Rural borrowers lack formal credit histories. AI uses alternative data points. It assesses creditworthiness accurately. This includes mobile usage or digital payment records. Therefore, more farmers get needed loans. This boosts their agricultural output.

Empowering Local Economies

AI financial tools strengthen local economies. They foster entrepreneurship. They also improve financial literacy. This leads to sustainable growth.

Micro-lending Opportunities

AI identifies suitable micro-loan applicants. It connects them with lenders. This process is faster and more efficient. Small businesses thrive with timely funds. Many women entrepreneurs benefit greatly. Consequently, local economies become more vibrant.

Skill Development Support

AI can recommend relevant training programs. It identifies skill gaps in a region. For instance, it suggests digital literacy courses. It also advises on vocational training. This increases earning potential. Therefore, AI supports long-term economic development.

Challenges and Future Outlook

AI financial planning faces hurdles. However, its future in India is bright. Addressing current issues is crucial. This ensures widespread adoption.

Digital Literacy Hurdles

Many rural residents lack digital skills. They may not own smartphones. Training programs are essential. Government and NGOs must collaborate. This will boost digital adoption. Therefore, financial access will improve.

Regulatory Frameworks

Robust regulations are necessary. They protect consumer data. Clear guidelines ensure fair practices. Regulators must adapt swiftly. This builds trust in AI solutions. Therefore, a secure environment is vital.

The future of AI in rural finance is promising. Expect more localized AI models. These models will understand regional dialects. They will offer hyper-personalized advice. By December 2025, AI will be a key enabler. It will drive financial empowerment across rural India.

FAQ Section

1. What is AI financial planning?

AI financial planning uses smart algorithms. It provides personalized money advice. It helps manage budgets and investments.

2. How does AI help rural farmers?

AI helps farmers manage income volatility. It suggests suitable loans. It also advises on crop insurance.

3. Is AI financial planning secure?

Yes, secure platforms protect data. Regulations ensure user privacy. Always use trusted service providers.