India’s Gen Z, comprising 27% of the population, is revolutionizing investment habits through digital platforms. With 60% saving regularly and 35% starting before age 25, this tech-savvy generation faces unique challenges including social media misinformation and overconfidence. Learn how Gen Z investment India trends are shaping the future while avoiding common pitfalls through smart strategies and expert guidance. Indwallet

Gen Z investors in India are leveraging smartphone technology for seamless investment experiences and financial planning

Table of Contents

How Can Gen Z Avoid Investment Pitfalls While Building Wealth in India?

Generation Z in India is transforming the investment landscape with unprecedented enthusiasm and digital fluency. Representing 27% of India’s population, this generation is not just participating in financial markets but actively reshaping them through technology-driven approaches and innovative investment strategies.

What are the Most Common Investment Mistakes Made by Gen Z in India?

Despite their technological prowess, Gen Z investors face several critical challenges that can derail their wealth-building journey:

- Social Media Misinformation: WhatsApp tips, unverified Instagram advice, and AI-generated deepfakes are leading to impulsive investment decisions

- Overconfidence Bias: Early investment success often breeds overconfidence, leading to excessive risk-taking

- Short-term Focus: The instant gratification culture conflicts with long-term wealth creation principles

- Lack of Diversification: Concentrating investments in trending sectors without proper risk management

- FOMO-driven Decisions: Fear of missing out on viral investment opportunities leads to poor timing

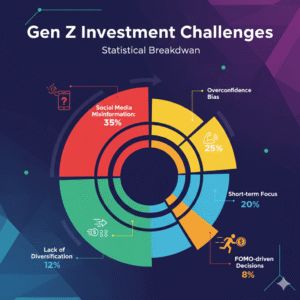

Gen Z Investment Challenges – Statistical Breakdown

Key Challenge Areas:

- Social Media Misinformation: 35% of Gen Z investors

- Overconfidence Bias: 25% of Gen Z investors

- Short-term Focus: 20% of Gen Z investors

- Lack of Diversification: 12% of Gen Z investors

- FOMO-driven Decisions: 8% of Gen Z investors

Primary investment challenges faced by Gen Z investors in India (Source: Market Research 2025)

“I’ve met some very smart Gen Z investors who honestly make me feel ashamed of my own knowledge. They are using technology brilliantly to analyze data, track companies, and process information far faster than we ever could. These young investors will become legends someday.”

– Nilesh Shah, Managing Director, Kotak Mahindra AMC

How Can Technology Help Gen Z Invest Smarter?

Gen Z’s digital nativity provides significant advantages when leveraged correctly:

- Investment Apps: Platforms like Zerodha, Groww, Upstox, and Kuvera offer user-friendly interfaces with educational content

- UPI Integration: Seamless payment systems enable instant transactions and micro-investments

- Robo-advisors: Algorithm-based portfolio management helps maintain disciplined investment approaches

- Real-time Analytics: Access to live market data and research tools for informed decision-making

- Goal-based Planning: Digital tools that align investments with specific financial objectives

Educational Resources for Gen Z Investors

Mutual Fund Summit 2025: GenZ Investment Insights

Expert insights on Gen Z investment trends and market opportunities

Investment Guide for Gen Z

Step-by-step guide on how Gen Z should begin their investment journey

Which Digital Investment Platforms are Leading the Gen Z Revolution?

What Investment Vehicles are Popular Among Indian Gen Z?

Gen Z investors are diversifying across multiple asset classes, showing sophisticated understanding of risk-return dynamics:

- Systematic Investment Plans (SIPs): 78% of Gen Z investors prefer SIPs for disciplined wealth creation

- Equity Mutual Funds: Professional management combined with diversification appeals to young investors

- Direct Equity: Tech-savvy investors are increasingly comfortable with stock picking

- ESG Investing: Environmental, Social, and Governance factors influence 45% of Gen Z investment decisions

- Digital Gold: Modern approach to traditional asset class through apps like Paytm Gold

- Cryptocurrency: Despite regulatory uncertainty, 23% show interest in digital assets

Gen Z Investment Preferences in India

Investment Preference Rankings:

Investment vehicle preferences among Gen Z investors in India (Source: Investment Survey 2025)

“This generation is far more confident about the future. But living off credit cards, indulging in instant gratification, copying investing styles seen online—these are habits that can cause long-term harm. Focus on investing, not trading. Long-term wealth is created through disciplined investing.”

– Nilesh Shah, Managing Director, Kotak Mahindra AMC

What Do Financial Experts Recommend for Gen Z Investors?

Leading financial experts emphasize several key strategies for Gen Z success:

- Education First: Build financial literacy before making investment decisions

- Start Early: Leverage the power of compounding through early investment habits

- Diversification: Spread investments across asset classes and sectors

- Regular Review: Monitor and rebalance portfolios quarterly

- Professional Guidance: Consult registered investment advisors for complex decisions

- Emergency Fund: Maintain 6-12 months of expenses before aggressive investing

Frequently Asked Questions

How much should Gen Z invest monthly in India?

Financial experts recommend investing 20-30% of monthly income, starting with as little as ₹500 per month through SIPs. The key is consistency rather than amount.

Are investment apps safe for Gen Z investors?

SEBI-registered platforms like Zerodha, Groww, and Upstox are safe. Always verify regulatory compliance and use two-factor authentication for security.

Should Gen Z invest in cryptocurrency in India?

While legal, cryptocurrency should represent no more than 5-10% of total portfolio due to high volatility and regulatory uncertainty. Focus on traditional assets first.

Gen Z’s approach to investing in India represents a paradigm shift toward digital-first, research-driven wealth creation. By avoiding common pitfalls, leveraging technology wisely, and following expert guidance, this generation is well-positioned to build substantial long-term wealth. The key lies in balancing technological advantages with fundamental investment principles and maintaining discipline in an increasingly complex financial landscape.