Key Takeaways:

- Understand crucial IPO lock-in rules in India for smart investing.

- Strategically plan your exit after the lock-in period concludes.

- Maximize returns by knowing precisely when to sell IPO shares.

Master IPO Lock-in Periods for Smart Gains

Excitement surges with every new Initial Public Offering (IPO). Many investors eagerly anticipate quick listing gains. However, a vital element often overlooked is the IPO lock-in period rules India. Ignoring these rules can lead to unexpected challenges. Understanding them helps you make truly informed decisions.

This lock-in period is a regulatory restriction. It prevents immediate selling of shares by certain investors. This ensures stability in a company’s stock price post-listing. Expert Rahul Jain recently discussed this in his insightful video “IPO Lock-in Periods Explained”. Knowing these rules is essential for every IPO investor. You can learn more about navigating market dynamics at indwallet.com.

What are IPO Lock-in Periods?

An IPO lock-in period restricts share transfers. It applies to promoters and anchor investors. This prevents a flood of shares immediately after listing. The Securities and Exchange Board of India (SEBI) mandates these rules. They aim to maintain market stability. This also builds investor confidence. Without lock-ins, prices could crash.

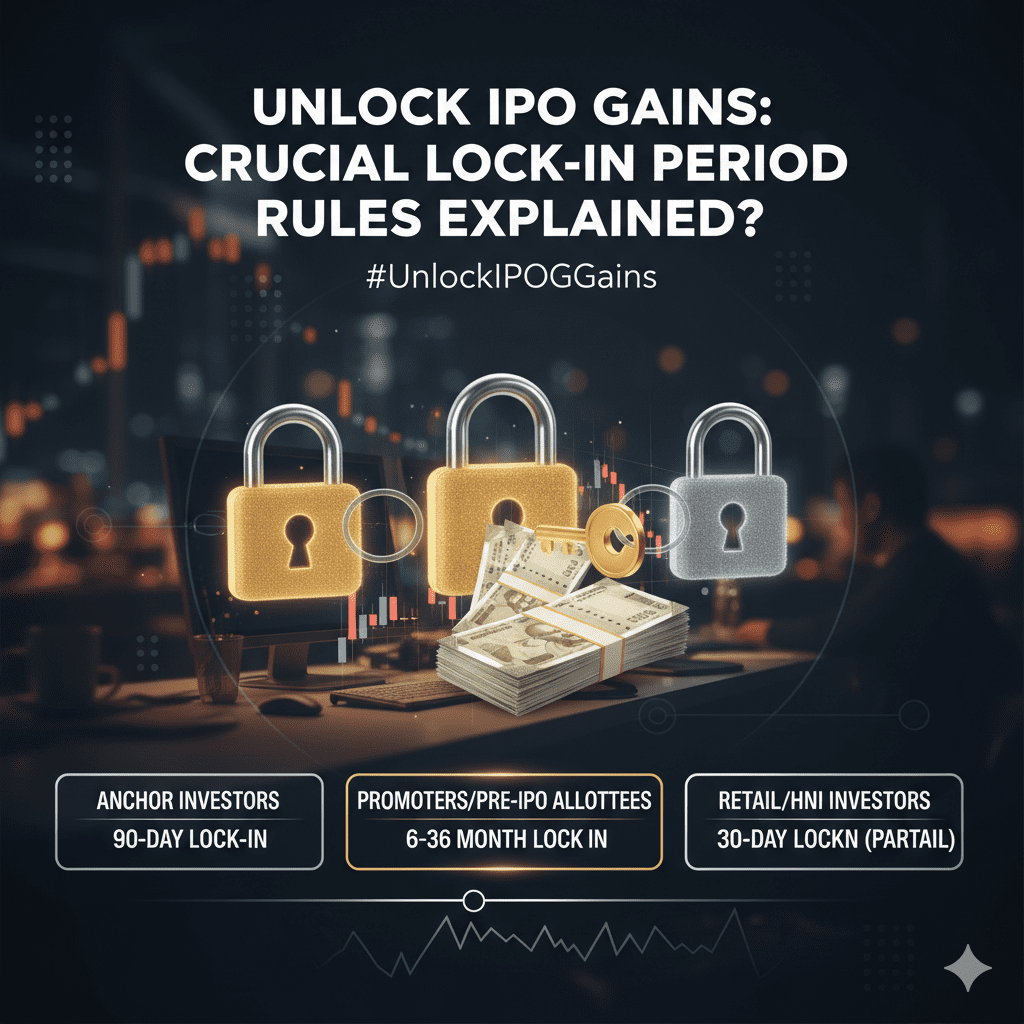

Crucial Lock-in Period Rules in India

SEBI regulations specify different lock-in durations. These depend on the investor category. Promoters face the longest restrictions.

- Promoter Shares: Promoters typically face an 18-month lock-in period. This period starts from the allotment date. It ensures their long-term commitment.

- Anchor Investors: Anchor investors usually have two lock-in periods. 50% of their shares are locked for 90 days. The remaining 50% are locked for 30 days.

- Non-Promoter Pre-Issue Shareholders: These investors, with some exceptions, face a six-month lock-in. SEBI recently clarified rules for pledged shares. Depositories now mark such shares as “non-transferable”. This prevents compliance issues.

Navigating Your IPO Investment Strategy

Understanding lock-in expiry is critical. A large volume of shares may become available for sale. This can sometimes lead to short-term price volatility.

- Monitor Expiry Dates: Track when major lock-ins end. This information is publicly available.

- Analyze Market Sentiment: Assess overall market conditions. A strong market might absorb selling pressure better.

- Consider Long-Term Holding: Do not rush to sell immediately. Evaluate the company’s fundamentals. Long-term growth can offer significant returns.

India’s IPO market remains robust. Over 200 companies plan to raise ₹2.6 lakh crore in 2026. This presents amazing opportunities. However, smart investors prioritize research and regulatory understanding.

FAQ Section

What is the IPO lock-in period?

It is a regulatory restriction. It prevents certain investors from selling shares. This happens for a specified time after an IPO.

How long is the IPO lock-in period in India?

Promoters face an 18-month lock-in. Non-promoter pre-issue shareholders have a six-month lock-in. Anchor investors have 30-day and 90-day periods.

When can I sell my IPO shares?

Retail investors can sell allotted shares immediately. Other investors must wait until their specific lock-in period ends.

References

- Rahul Jain. “IPO Lock-in Periods Explained.” YouTube, uploaded by Rahul Jain (@torahulj), 9 Feb. 2026, .

- “SEBI To Ease Lock-In Norms Of Pledged Pre-IPO Shares For Non-Promoters.” NDTV Profit, 17 Dec. 2025.

- “India IPO 2026: 200+ Firms Target Rs 2.6 Lakh Cr, Retail Demand Softens.” TradeKaizen, 5 Jan. 2026.

Leave a Reply