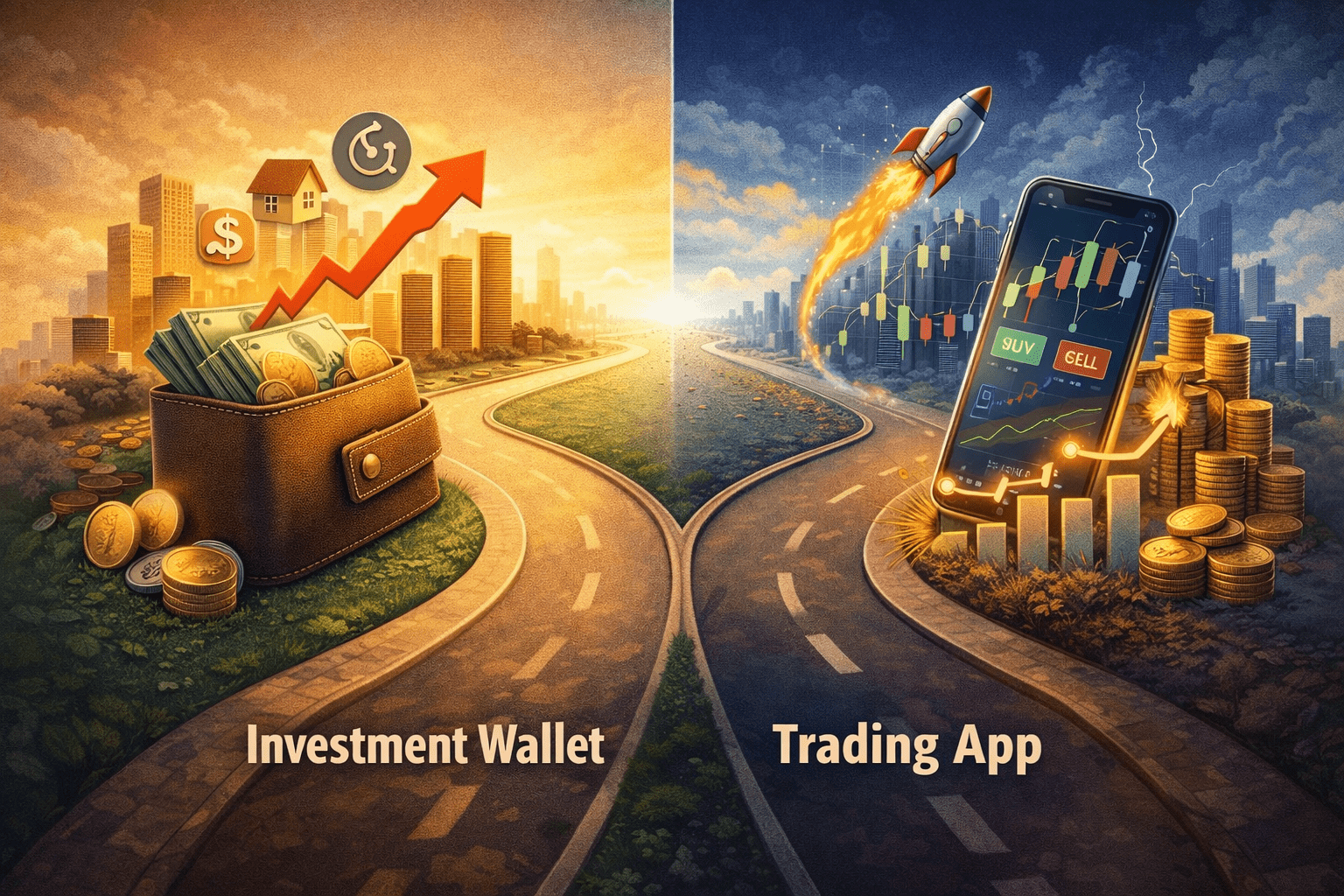

Navigating India’s financial landscape can be complex. You might wonder about an investment wallet vs trading app. This guide clarifies their roles. It helps you choose the best tool for your financial goals. Moreover, it considers today’s volatile market conditions.

The Indian financial market offers many digital tools. Choosing between an investment wallet and a trading app is a key decision. Both serve distinct purposes. Your financial goals should guide your choice. Let’s explore these options thoroughly.

Understanding Investment Wallets

An investment wallet typically focuses on long-term growth. It helps you build wealth steadily. These platforms usually offer mutual funds, fixed deposits, or bonds. They are ideal for beginners. Furthermore, they suit those with a low-risk appetite.

Global economic weakening currently makes stable investments attractive. Therefore, a diversified investment wallet can offer security. It safeguards against market volatility. This approach also helps mitigate debt crisis concerns.

What are Trading Apps?

Trading apps, conversely, are for active market participation. They allow buying and selling stocks, derivatives, and commodities. These apps suit experienced investors. They are for those seeking quicker returns. However, they carry higher risks.

Recent AI bubble concerns highlight speculative market dangers. Similarly, US-China-EU trade tensions create market swings. Trading apps facilitate capitalizing on these fluctuations. Yet, caution is always advised.

Investment Wallet vs Trading App: Key Differences

The core difference lies in their approach. Investment wallets promote a “buy and hold” strategy. They prioritize compounding returns over time. Trading apps, on the other hand, focus on short-term trades. They aim to profit from price movements. This distinction is crucial. It impacts your risk exposure and time commitment.

- Goal: Long-term wealth vs. Short-term gains.

- Risk: Generally lower vs. Generally higher.

- Complexity: Simpler interface vs. Advanced tools.

- Market Focus: Diversification vs. Specific asset movements.

Navigating Wallet Wars and Security

The “wallet wars” refer to the intense competition. Many platforms vie for users. Each offers unique features and incentives. However, amid this competition, security remains paramount. Cybersecurity threats are constantly evolving.

Both investment wallets and trading apps handle sensitive financial data. Therefore, choosing platforms with robust security measures is vital. Always look for two-factor authentication. Check for encryption protocols. Ensure your funds are safe from digital attacks.

Making Your Informed Choice in India

Consider your personal financial situation carefully. Define your investment horizon. Assess your risk tolerance honestly. If you seek steady, long-term growth, an investment wallet is better. For active trading and higher risk, a trading app might suit you.

Many platforms now offer hybrid models. They combine features of both. This flexibility helps cater to diverse investor needs. Remember, informed decisions lead to better outcomes.

Frequently Asked Questions (FAQ)

Q1: What is the main benefit of an investment wallet over a trading app for a beginner?

A1: An investment wallet is generally simpler. It focuses on long-term, diversified investments. This makes it ideal for beginners. It avoids the complexities and higher risks of active trading.

Q2: Can I use both an investment wallet and a trading app?

A2: Yes, absolutely! Many savvy Indian investors use both. They use an investment wallet for core long-term savings. Then, they use a trading app for smaller, speculative short-term opportunities. This balances risk and growth potential.

Q3: How do global economic weakening and debt crisis impact my choice?

A3: These factors suggest increased market volatility. Therefore, a stable investment wallet can provide a safer haven. However, a trading app could exploit short-term market movements if you are experienced and risk-tolerant.

Q4: What should I look for regarding cybersecurity when choosing a platform?

A4: Always prioritize platforms with strong encryption. Look for two-factor authentication. Check for regular security audits. Also, ensure they have clear data privacy policies. This protects your financial data from threats.

For further reading on securing your digital finances, please refer to guidelines by the Reserve Bank of India.

Leave a Reply