Why Did SIP Inflows Hit 29K Crores?

SIP inflows crossed historic Rs. 29,000 crore in November 2025. Explore factors driving this massive growth in retail investing. Start your SIP journey today!

Summary

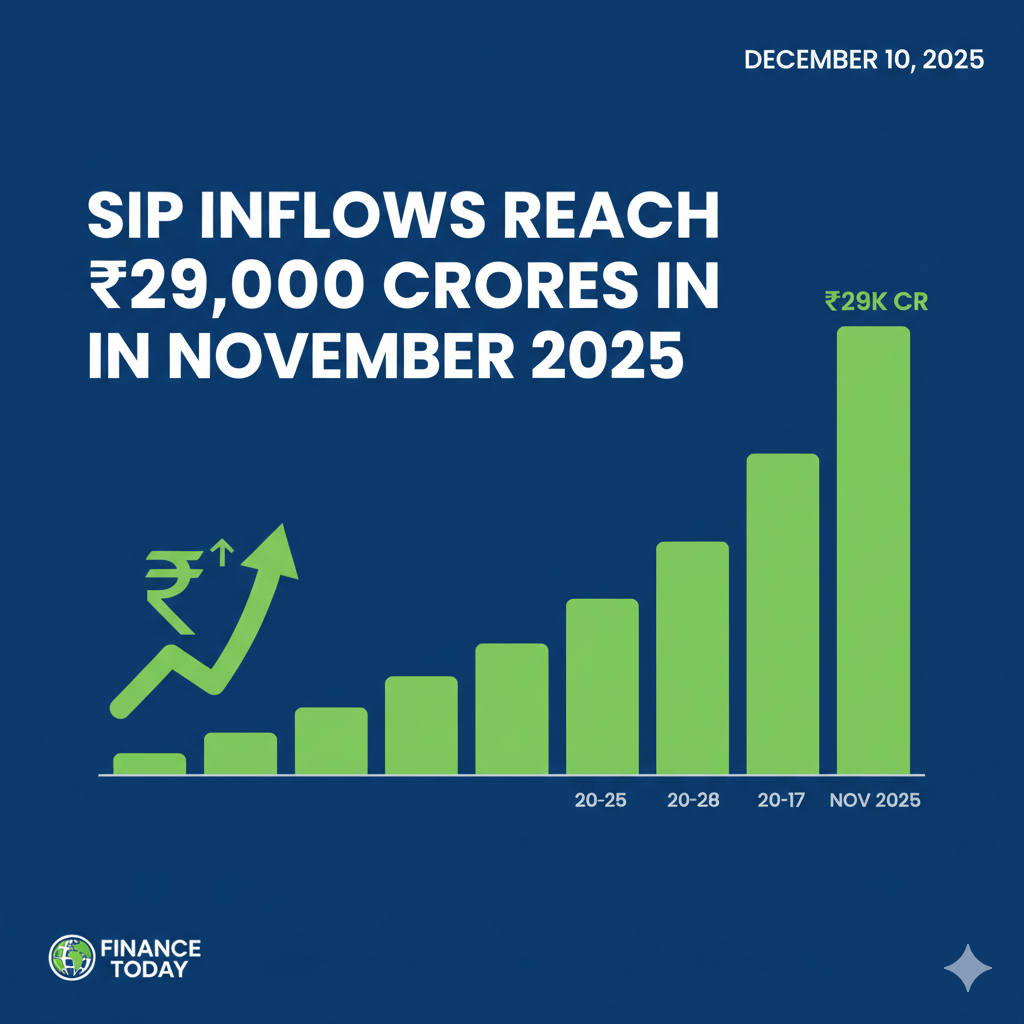

November 2025 marks a historic moment for India’s retail investment landscape. For the first time, monthly inflows into mutual funds via Systematic Investment Plans (SIP) breached the Rs. 29,000 crore mark. This achievement reflects years of growing investor confidence, digital accessibility, and a fundamental shift in how Indians approach wealth creation. The milestone underscores retail investors’ unwavering faith in India’s growth story through disciplined SIP investing.

The Pillars of Unprecedented Growth

Reaching this historic figure was powered by several converging trends. The journey from just over Rs. 20,000 crore in mid-2024 to today’s Rs. 29,000 crore highlights an accelerated adoption curve.

Democratization of Investing Through Technology

The proliferation of user-friendly fintech platforms and mobile apps has dismantled previous barriers to entry. Today, anyone with a smartphone can start a Systematic Investment Plan with as little as Rs. 500. This digital revolution has brought tier-2 and tier-3 cities into the investment fold, dramatically expanding the investor base to over 9 crore SIP accounts.

Resilience of the Indian Economy

Despite global headwinds, the Indian economy has demonstrated remarkable resilience. Consistent GDP growth and strong corporate earnings have reinforced investor confidence. Retail investors now view market dips as buying opportunities, showing mature investment behavior.

Expert Commentary on the Sustainable Trend

Industry leaders have long predicted this trajectory, citing the structural nature of this shift. The consistent growth is seen not as a bubble, but as a long-term trend towards financialization of domestic savings.

This long-term vision is supported by AMFI data showing consistent rise in both amount and number of SIP accounts. AMFI’s data shows that the average SIP holding period is increasing, which is a positive sign for market stability.

What This Means for Investors

The Rs. 30,000 crore milestone reflects the collective financial discipline of millions of Indians. For existing investors, it reaffirms they are part of a powerful, long-term structural trend. For those yet to start, it serves as compelling reason to begin.

The power of compounding, which is the core benefit of a long-term SIP, works best with an early start. You can learn more about crafting your investment strategy at INDwallet.com. This trend brings greater market stability, as consistent domestic retail flows counterbalance volatile foreign institutional investments.

Frequently Asked Questions

Is it too late to start a SIP investment now?

No, it is never too late. The best time to start was yesterday, and the second-best time is today. The principle of SIP is ‘time in the market’, not ‘timing the market’. As explained in the first educational video above, a SIP helps you average costs over time, making any time good to start your long-term investment journey.

How does a Systematic Investment Plan benefit from compounding?

A SIP allows you to invest a fixed amount regularly. Returns earned are reinvested, and in the next cycle, you earn returns on original capital plus accumulated returns. This compounding process is explained in detail in the second educational video above, showing how this ‘snowball effect’ creates significant wealth over the long term.

With SIP inflows so high, is the market overvalued?

High SIP inflows indicate strong domestic investor confidence. While market valuations fluctuate, a SIP is designed to navigate these cycles. By investing a fixed amount regularly, you automatically buy more units when the market is low and fewer when high (rupee cost averaging), as demonstrated in both educational videos above.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Mutual fund investments are subject to market risks. Please read all scheme-related documents carefully before investing. Consult with a qualified financial advisor for personalized investment guidance.