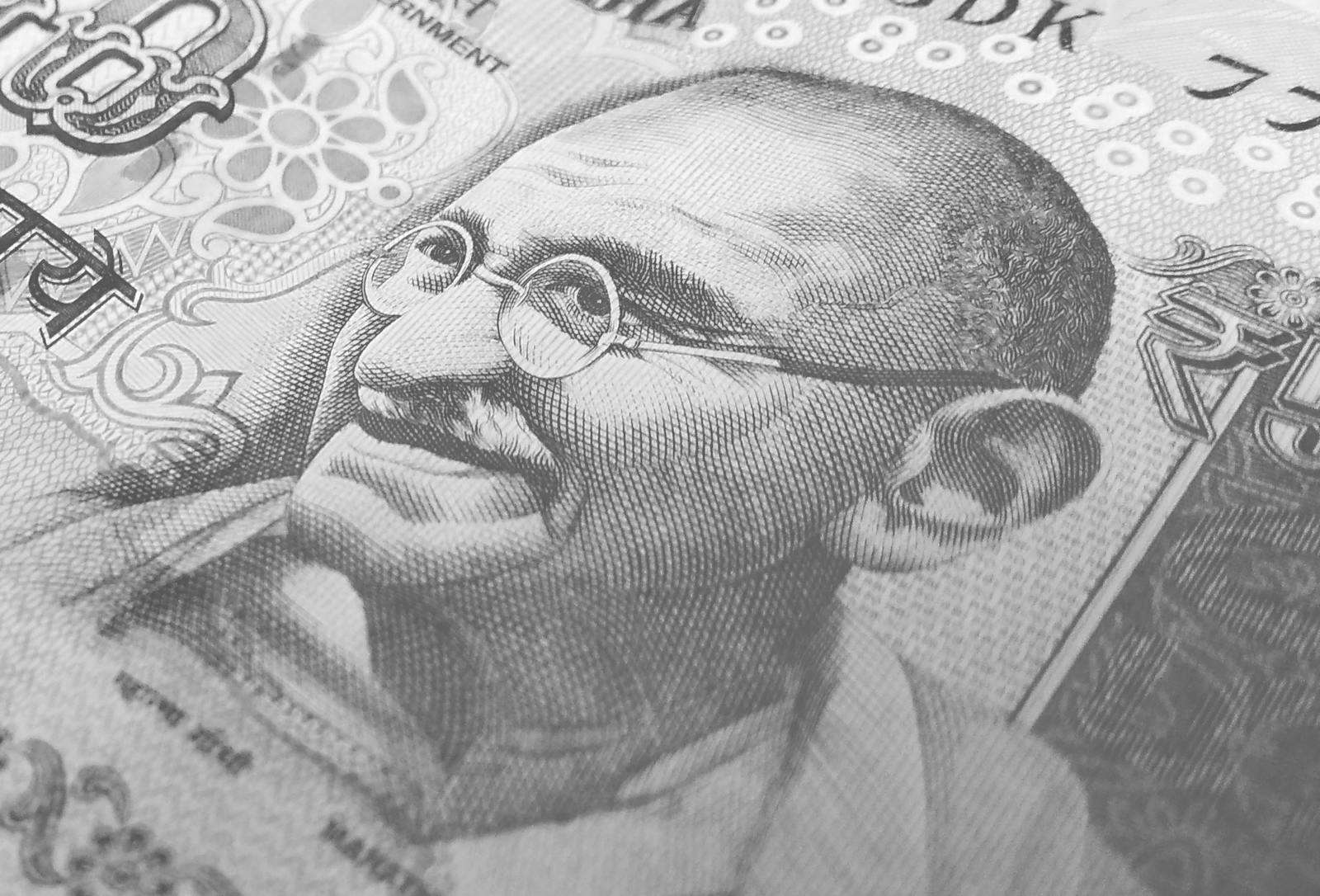

Indian Rupee Forecast for 2024: Expert Insights

The Indian Rupee has a long history, evolving from ancient coinage to its current status as a fiat currency. Its value has been shaped by various factors, including colonial exchanges, global economic changes, and domestic monetary policies. The Indian Rupee is not just a medium of exchange; it reflects India’s economic pulse, mirroring the broader economic growth and diversification.

Today, the Indian Rupee serves as a barometer of global economic trends. Its value is influenced by factors such as inflation rates, foreign exchange reserves, current account deficits, and government policies. The exchange rate between the rupee and the US Dollar is often a key indicator of the health of India’s foreign trade and investment climate.

Current State of the Indian Rupee

Over the past year, the Indian Rupee has experienced significant fluctuations, influenced by a combination of domestic and global factors. Despite these challenges, the currency has shown resilience, maintaining a relatively stable range against the US Dollar.

Government policies and actions by the Reserve Bank of India (RBI) have played a crucial role in stabilizing the rupee. Efforts to control inflation, manage interest rates, and increase foreign exchange reserves have helped bolster the currency. These strategies have mitigated the adverse effects of global inflationary trends and geopolitical tensions, such as the ongoing conflict in Eastern Europe and fluctuating oil prices.

The strength of the US Dollar has impacted the Indian Rupee. The US currency has appreciated due to the Federal Reserve’s interest rate hikes, which attract investors to US assets and put downward pressure on the rupee. However, analysts suggest that a potential weakening of the US Dollar in the coming years could provide some relief, making the rupee stronger.

Expert Opinions on the Indian Rupee’s Future

Experts offer varied perspectives on the Indian Rupee’s future. Former RBI Governor Dr. Raghuram Rajan predicts a moderate depreciation of the rupee against the US Dollar due to ongoing global uncertainties. He highlights the influence of the US Dollar’s strength and the Federal Reserve’s policies as significant factors.

On the other hand, financial analyst Anjali Verma from PhillipCapital India offers an optimistic outlook, predicting a stable or appreciating trend for the rupee. Verma believes that expected capital inflows driven by Foreign Direct Investment (FDI) and portfolio investments, along with economic reforms, will play a key role in bolstering the rupee.

Former World Bank Chief Economist Kaushik Basu provides a balanced view, suggesting that while the Indian economy shows resilience, the rupee’s future remains tied to global geopolitical developments and crude oil price fluctuations.

Is the Indian Currency Booming?

The Indian Rupee has been the subject of debate, especially regarding its performance against global currencies like the US Dollar. To determine whether the Indian currency is booming, several key economic indicators must be examined, including GDP growth, inflation rates, and foreign investment levels.

India’s GDP growth, currently hovering around 6-7%, often bolsters confidence in the rupee. However, inflation rates also play a crucial role. The Reserve Bank of India has implemented policies to curb inflation, strengthening the rupee. Additionally, foreign investment, particularly in sectors like technology and manufacturing, has positively influenced the rupee’s value against major currencies like the US Dollar.

Potential for Appreciation of the Indian Currency

The Indian Rupee has seen periods of volatility and stability, with its future depending on factors such as government policies, economic reforms, trade balances, and global trends. Government initiatives like Make in India and Production Linked Incentive (PLI) schemes aim to attract foreign investment, potentially strengthening the rupee.

Economic reforms, such as the implementation of the Goods and Services Tax (GST) and banking sector improvements, are pivotal for ensuring financial stability and bolstering the rupee. A favorable trade balance, where exports exceed imports, could also lead to the appreciation of the rupee. Expanding exports in sectors like IT, pharmaceuticals, and textiles can improve the trade balance, supporting the rupee’s value.

Global economic trends, including the performance of key trading partners and international investment flows, also influence the rupee’s trajectory. The ongoing interest in BRICS countries and a potential decline in the US Dollar could create an environment conducive to the appreciation of the Indian currency.

Reliance on the US Dollar

The Indian Rupee’s dependency on the US Dollar has long been significant, affecting trade dynamics, foreign exchange reserves, and overall economic stability. The predominance of the US Dollar as the global reserve currency means that the rupee often mirrors the fortunes of the dollar, influencing India’s trade activities.

Foreign exchange reserves, predominantly held in US Dollars, serve as a buffer for economic stability. Fluctuations in the value of the dollar can impact the valuation of these reserves. An appreciating US Dollar can inflate India’s foreign debt burden, straining public finances and potentially leading to economic volatility.

The correlation between the US Dollar and the Indian Rupee also affects Foreign Direct Investment (FDI) and Foreign Portfolio Investment (FPI) inflows into India. A stronger dollar often diverts investors to US assets, reducing capital influx to emerging markets like India. Conversely, a weaker US Dollar can bolster inflows into the Indian economy, providing capital for growth and development projects.

Role of BRICS in Strengthening the Indian Currency

The BRICS coalition, comprising Brazil, Russia, India, China, and South Africa, plays a crucial role in strengthening the Indian Rupee. As these countries deepen economic ties, the potential for bolstering the rupee becomes more pronounced. Increased trade agreements within BRICS could reduce dependency on the US Dollar for international transactions, providing a cushion against global market volatilities.

India’s strategic collaborations within BRICS, particularly in technology, energy, and infrastructure development, could significantly contribute to economic resilience. These investments can spur growth and innovation, positioning India as a robust player in various sectors. The resultant economic growth would naturally lead to a stronger rupee, better shielded against global economic downturns and currency depreciation.

The establishment of the New Development Bank (NDB), founded by BRICS countries, presents a noteworthy milestone. By relying less on the US Dollar and more on mutual financial support within BRICS, India can ensure a more stable and resilient rupee. The future of the Indian Rupee in 2024 will depend on external economic conditions, domestic fiscal policies, and global economic trends.